In recent years, the concept of minimalism has swept through our culture, presenting itself as a beacon of tranquility and simplicity in our increasingly cluttered lives. At its core, minimalism is about stripping away the unnecessary, focusing on what truly adds value to our lives, and fostering a sense of peace and contentment with less.

Table of Contents

ToggleDoes a Minimalist Budget Work?

A minimalist on a budget simplifies financial management by providing a bird’s-eye view of your spending, rather than nitpicking over minor overages, like spending an extra $8 on your coffee budget. The principle of keeping it super simple perfectly applies here.

Essentially, a minimalist budget is a “set it and forget it” strategy whereby your fixed monthly expenses, savings and investment are set up on auto payments. That accounts for about 70% of your monthly income so you only have to be mindful of the 30% your free to spend on whatever you like hobbies, entertainment, luxury items etc.

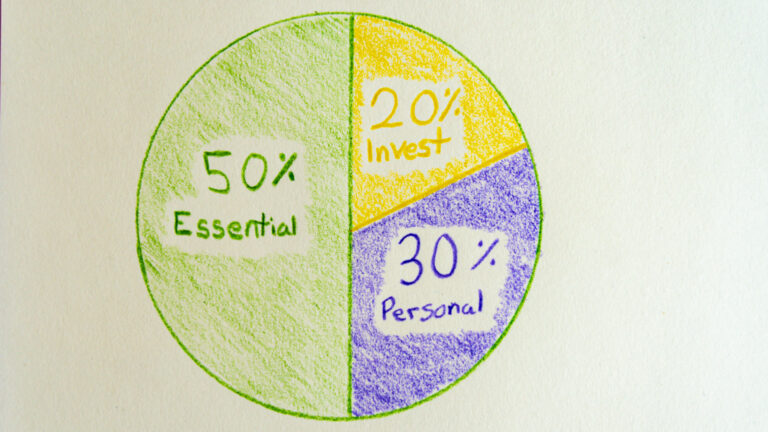

By categorizing your spending into three main categories: 50% for needs, 30% for wants, and 20% for savings, you can ensure you’re on the right track if you stay within these limits.

Moreover, a minimalist budget helps prevent the pitfall of lifestyle creep. This phenomenon affected a friend of mine who began earning significantly more. Despite his substantial income, climbing into the six figures, his expenses increased with his income, leaving him stressed and living paycheck to paycheck.

Understanding Minimalism

Minimalism goes beyond the mere act of owning fewer possessions; it’s a lifestyle choice rooted in simplicity, intentionality, and a focus on what’s genuinely important. This philosophy encourages us to question the necessity and purpose of our possessions, urging us to make more conscious choices about what we allow into our lives. Contrary to popular belief, minimalism is not about adhering to a strict number of items but about finding your own balance and what brings you joy and peace.

Adopting a minimalist lifestyle on a budget doesn’t just benefit your wallet; it offers a multitude of advantages:

- Financial Freedom and Reduced Expenses: By curbing unnecessary spending, minimalism allows for a greater allocation of resources towards savings and debt repayment.

- Quality over Quantity: A minimalist mindset prioritizes the acquisition of fewer, but better-quality items that last longer and truly meet our needs.

- Decreased Stress and Clutter: A decluttered space reflects a decluttered mind, leading to reduced anxiety and a more serene environment.

- Environmental Impact: Minimalism promotes sustainability through reduced consumption, minimizing our ecological footprint.

How to be a minimalist on a budget?

Creating a minimalist budget is a key step in this journey, allowing you to streamline your spending, save money, and invest in experiences and items that genuinely add value to your life. In this section, we’ll dive into practical strategies and tips for crafting a minimalist budget that aligns with your goals and lifestyle, helping you achieve financial freedom and peace of mind. Let’s explore how you can make more room for joy and less for unnecessary expenses.

Make a list of all your expenses

The first step in creating a minimalist budget involves meticulously documenting all your expenses. Then, critically evaluate each item by asking, “Do I truly need this?” and “Can a less expensive alternative provide the same value?” A prime example is the potential savings on cell phone plans. Many aren’t aware that they can enjoy the same network coverage offered by major carriers like AT&T or Verizon at half the cost through private label carriers, such as Straight Talk Wireless. Methodically analyze each expense on your list and eliminate unnecessary spending.

Essential vs. Discretionary Expenses

Essential spending is crucial for basic living, including housing, utilities, groceries, healthcare, and transportation. These are expenses one cannot avoid, yet they can sometimes blur into discretionary spending. For instance, while transportation is essential, opting for a luxury vehicle like a BMW M4 is not. That’s an example of lifestyle creep, where instead of investing extra income, individuals spend it on luxury items. You might look wealthy but often results in living paycheck to paycheck to maintain these expenditures.

How to budget with a 50/20/30 Budget

The 50/20/30 budgeting rule is a simple and effective method for managing your finances, promoting a balanced approach to saving and spending. This rule suggests allocating:

- 50% essential expenses, such as rent, utilities, and groceries, ensuring your basic needs are met.

- 20% savings and debt repayment, encouraging financial security and growth over time.

- 30% is reserved for personal spending on non-essential items, like dining out, entertainment, and hobbies.

- If you have bad debt or want to retire younger, I suggest using the 30% for additional savings and debt repayments.

This method not only helps in maintaining a healthy financial lifestyle but also in achieving your financial goals, whether that’s building an emergency fund, paying off debt, or saving for a vacation. By dividing your income into these three categories, the 50/20/30 rule simplifies financial planning and fosters a mindful approach to how your money is spent and saved.

Practical Tips for Adopting Minimalism on a Budget

Spending more means spending less

I learned a valuable lesson early on, the hard way, but I’m eager to share my experience with you so you can save money and make smarter purchases. It’s tempting to opt for the cheapest products available when we need to buy something. However, this approach has cost me thousands of dollars over the years until I understood the crucial difference between ‘cheap’ and ‘inexpensive.’ Cheap products are poorly made by untrustworthy brands, whereas inexpensive items are of high quality from reputable brands.

A vivid example of this lesson occurred when I purchased low-cost $100 fly fishing waders in Alaska for a fishing trip. The plan was to float down the Kenai River for a week of fishing. To test their reliability, I filled my bathtub with water to check for leaks, and unsurprisingly, they leaked right out of the box! Had I not tested the waders before reaching our remote campsite, I would have been unable to fish, turning a $1,000 plane trip to Alaska into a disappointing experience. Instead, I promptly returned the defective waders and invested in a pair of entry-level waders from Simms, the leading brand in the industry, for $200. After 7 years and countless fishing trips, they have not leaked once, proving that investing in quality pays off in the long run. This experience taught me that while buying quality items may be slightly more expensive upfront, it ultimately saves you stress and money. Remember, it’s not about purchasing the most expensive product with all the bells and whistles but about investing in what you truly need and ensuring it’s of good quality.

Automatic Payments & Credit Cards

I like to keep things simple in my life which allows me to do more with my time, so I set up automatic payments on everything. Usually, I have everything billing to a credit card which is then paid off every month by another automatic payment from my checking account. This does a few things:

- Everything is paid for on time.

- Builds my credit with on time payment history.

- Earns cash back or points on my credit cards. FREE MONEY!

Setting up automatic transfers to savings and investment accounts is also important. If savings and investment accounts are set up to automatically transfer out, you’re much more likely to follow through with it. In my mind, it’s just another essential bill that must be paid except this “bill” is building my wealth and financial freedom!

Remember, if there’s a way to set something up to be done automatically, DO IT!

Regular Check Ups

In life, we set a goal to achieve and begin working towards it. For many of us, myself included, it’s easy to get sidetracked and deviate from the path toward that goal. It’s okay! One of the most valuable lessons I’ve learned was from Ray Dalio’s book “Principles.” Ray discusses setting a goal, making mistakes, learning from those mistakes, adjusting, and then refocusing on the goal. Simply put, if you fall off the horse, figure out why you fell off and get back on. True failure isn’t falling off the horse, it’s not getting back on.

That’s why it’s important to regularly check in on your budget, perhaps once a month, to ensure you’re not exceeding your limits. If you do exceed your limits, just examine why, and make the necessary adjustments to get back on track.

Extreme Minimalist Budgeting

Embarking on a journey to financial freedom and the possibility of early retirement is a dream many aspire to, yet it often seems like a distant reality. Traditional budgeting advice, such as the commonly referenced 50/20/30 rule—where 50% of your income goes to necessities, 20% to savings, and 30% to personal spending—offers a foundational guideline, but it may not be aggressive enough for those seeking to break free from the rat race at an accelerated pace. The strategy I’m about to delve into is more radical, demanding a higher level of discipline and sacrifice, but the rewards it promises are equally substantial.

The essence of this approach is not rooted in adhering to strict percentage allocations but in dramatically reducing your expenditure on both essential and discretionary categories. The goal is to live as frugally as possible without compromising your well-being. This means minimizing your living expenses to a level that is comfortably sustainable, yet significantly below your means. Whether you’re making a modest income or earning well into six figures, the principle remains the same: live on a fraction of what you earn, and channel the surplus into vehicles that will fuel your financial growth.

For example, if you’re a high earner with an annual income in the six figures, you might choose to adopt a lifestyle that only expends $60,000 a year. Alternatively, someone earning less might aim to live on even less, adjusting their budget to reflect their earnings while maintaining the principle of minimizing expenses. The key is to find a balance that allows you to live comfortably yet frugally, cutting out unnecessary expenditures and focusing on what truly adds value to your life.

The surplus income, which is essentially the difference between what you earn and what you spend, should then be strategically deployed to accelerate your journey towards financial independence. This involves two primary actions: investing and debt repayment. Investing could mean putting extra money into retirement accounts, such as IRAs or 401(k)s, or exploring other investment avenues like real estate, stocks, or bonds that align with your risk tolerance and financial goals. The objective is to let your money work for you, generating additional income through interest, dividends, and capital gains.

On the other hand, paying off bad debt is equally crucial. High-interest debts, such as credit card balances or personal loans, can significantly hinder your financial progress. By aggressively paying down these debts, you not only save on interest payments but also free up more of your income for investment and savings, further compounding your ability to generate wealth.

This aggressive approach to escaping the rat race and achieving early retirement is not without its challenges. It requires a significant shift in mindset, from one of immediate gratification to long-term financial well-being. Living below your means, especially in a consumer-driven society, demands discipline, planning, and a clear understanding of your financial goals. However, for those willing to embrace this lifestyle, the rewards can be life-changing. Not only does it offer the possibility of financial freedom and early retirement, but it also promotes a simpler, more intentional way of living that focuses on what truly matters.

In summary, this strategy is about more than just cutting costs or saving a portion of your income; it’s about fundamentally rethinking your relationship with money, spending, and investing. By drastically reducing your expenses, living frugally, and wisely managing the surplus, you can set a powerful foundation for financial independence and the freedom to live life on your own terms.